The Importance of Customer Service in Van Leasing

Van leasing is a great way to invest in your business. And while we know it’s much more cost-efficient than buying, it’s still […]

December 19th, 2016

You’ve finally taken the leap and started working for yourself. It’s an exciting time in your career. However, among the endless things every entrepreneur needs to sort out—your budget, advertising, taxes, insurance—maybe you’ve decided you’ll need a vehicle, too.

You’re not alone. For tradesmen, florist, delivery drivers, and many small business owners in the UK, their vans are the bedrock of their operation. They simply wouldn’t be able to do what they do without them.

But when you’re a new business, financing a van might seem like a risky undertaking. Your financial situation may be uncertain. How can you afford to drop the cash on a new vehicle, if you’re not sure exactly what you’ll be earning in the coming months? What if it breaks down, and you’re unable to work and earn money?

Well, it’s not “magic” per se, but Finance Lease can be brilliantly useful if you find yourself in this situation.

This solves the ‘chicken-or-the-egg’ problem. You can get a reliable vehicle with fixed costs, with a low amount of money involved. You can use it to build up your business, and sort out any larger costs down the line when you’ve built up credit.

Plus, you can take full advantage of your self-employed tax situation. Here’s how it works…

If you’re doing a normal ‘hire purchase’ scenario, your costs would be calculated as follows. Imagine you buy a hypothetical van which costs £10,000.

Calculating your monthly payments would look something like this…

You have the cost of the vehicle, plus the tax, divided by how long you’re financing it over. Your monthly payment would equal £208.

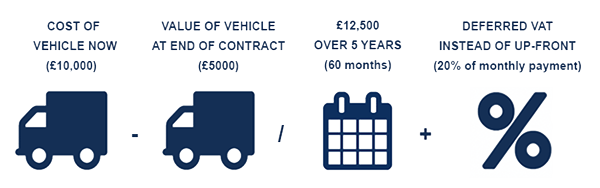

Now, if you’re doing a Finance Lease on a van, the math will look more like this…

Your monthly payment would equal £145+VAT.

You get to exclude VAT (provided you are VAT-registered, and using your vehicle for your business). So right out of the gate, you get to claim 20% back in your pocket.

Secondly, you only have to make payments based on the value of the vehicle while you’re using it. So on our hypothetical £10,000 vehicle — if we determine it will be worth £5000 in 5 years time, we subtract that from the total. So you will pay payments on the first £5000 of it’s worth, divided by your finance period.

Once the contract is up, you have two options. You can either pay the “balloon”, which is the market price of the vehicle once you’re finished with it, and you can keep the vehicle.

Or, you can dispose of it, and get a payment for the equity you built into the vehicle over time.

Ultimately, it’s going to boil down to your personal situation. There are pro’s and con’s to any approach.

To summarise, Finance Lease on a van can be a useful tool if applied correctly when starting up your business.

It helps you keep costs low in the beginning, while giving you an asset to build a strong financial foundation. You can minimise the risks of repairs, whilst taking full advantage of your unique tax situation while you’re building your business up.

Once you’re finished—you can either sell it for profit, or renew!

If you think you’d like to pursue this, or you still have more questions—why not speak with one of our advisers. We know finance lease inside-and-out and would be happy to help.

Van leasing is a great way to invest in your business. And while we know it’s much more cost-efficient than buying, it’s still […]

Looking for a large van lease, but you’re not sure which van to choose? We’ve got you covered. In this article, we’ll walk […]

Whether you’re a window cleaner needing to transport a 1000L tank, or you just need to make sure you can get materials and […]

Leasing a vehicle has lots of benefits for businesses. You’re able to spread the cost of your vehicle across the term of the […]

Commercial pick-ups are versatile, multi-functional vehicles. You can carry heavy loads, tow, and even transport your team. With major manufacturers offering great commercial […]

Finding the right van for you and your business is important. As the best-selling commercial vehicle in the UK the Ford Transit Custom […]

As we all pay more attention to how we are affecting the environment, you may have considered how you can reduce the environmental […]