The Importance of Customer Service in Van Leasing

Van leasing is a great way to invest in your business. And while we know it’s much more cost-efficient than buying, it’s still […]

July 30th, 2018

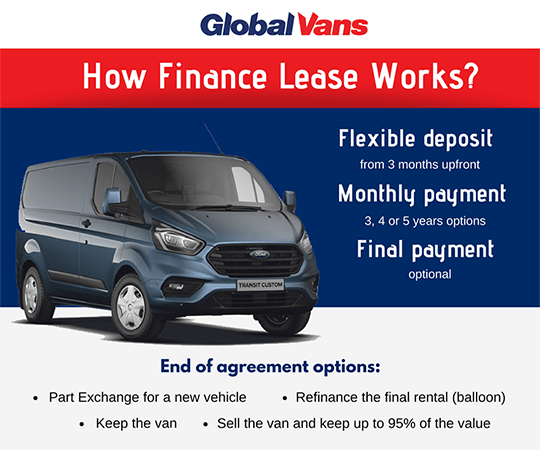

What is a “Finance Lease”?

A business finance lease is a form of funding whereby a lease company buys a vehicle and

rents it back to a client over an agreed schedule of rentals sometimes including a residual

value rental*.The risks and rewards of ownership are held with the client and they must

maintain and insure the vehicle appropriately.

Ownership

To benefit from the tax advantages of leasing you do not own the vehicle during the contract. At the end of the minimum

period of hire, you cannot take direct ownership of the vehicle. If you wish to own the vehicle you must sell the

vehicle to an unrelated third party, This is a paperwork exercise to comply with the

finance lease agreement’s terms and conditions. Be aware finance companies will always say you

cannot take direct ownership of the vehicle.

Final rentals*:

Final rentals are the client’s responsibility, and the value of the vehicle may be worth less than your final

rental. Values are dependent on common-sense factors, such as vehicle mileage, condition

and market forces.

Tax

All rentals are subject to VAT and are 100% offset against revenue for business use.i.e. if the company made a profit of £20,000 in a year

and the rentals added up to £3,600 (12 *£300) the company would pay tax on only the £16,400 (e.g. 20%).

The asset and liability will appear on your balance sheet.

VAT

End of Lease Options

VAT is spread, meaning that instead of it being paid up front (like with Hire Purchase),

VAT is attributed to each rental (currently at 20%).

End of Lease Options

1. Do Nothing and keep using the vehicle: the final rental (balloon) will come out of your bank account by Direct Debit and you will then enter the

‘secondary term’/’secondary rental period’, you’ll then pay an ‘annual rental’/’peppercorn’ of a few hundred pounds a year.

2. Keep the vehicle (and avoid the secondary rental period): To avoid the ‘secondary rental period’ you’ll need to end the lease. We will help you

with this, you’ll need to sell the vehicle to an unrelated third party and send a small percentage of the invoice value (ranges

from 2% to 5% depending on the finance company) along with the invoice to the finance company. To keep the vehicle the third party can simply invoice you back for the vehicle.

3. Part Exchange for a new vehicle: You can part exchange the vehicle with us for a new model, you’ll benefit from any equity in the vehicle which

you can put towards the deposit on your new vehicle.

4. Sell the vehicle: You can advertise the vehicle privately and sell on behalf of the leasing company. You’ll need to settle the final rental and send

the leasing company a small percentage of the sales invoice value (ranges from 2% to 5% depending on the finance company).

5. Refinance the final rental (balloon): We can provide a quotation to refinance the balloon over a further agreed period (subject to credit approval).

Van leasing is a great way to invest in your business. And while we know it’s much more cost-efficient than buying, it’s still […]

Looking for a large van lease, but you’re not sure which van to choose? We’ve got you covered. In this article, we’ll walk […]

Whether you’re a window cleaner needing to transport a 1000L tank, or you just need to make sure you can get materials and […]

Leasing a vehicle has lots of benefits for businesses. You’re able to spread the cost of your vehicle across the term of the […]

Commercial pick-ups are versatile, multi-functional vehicles. You can carry heavy loads, tow, and even transport your team. With major manufacturers offering great commercial […]

Finding the right van for you and your business is important. As the best-selling commercial vehicle in the UK the Ford Transit Custom […]

As we all pay more attention to how we are affecting the environment, you may have considered how you can reduce the environmental […]