What to Expect When Leasing a Van on Finance

A guide to leasing vans through finance deals, including how they work and common terms. Van financing, also known as van leasing, works […]

February 17th, 2021

If you’re thinking about investing in a new van, and haven’t leased a vehicle before, it’s important to understand the difference between the types of finance agreement.

Many businesses have seen the advantages of van leasing rather than buying, allowing them to spread the cost over an agreed term rather than forking out a chunk of capital upfront.

Van leasing can seem complicated, especially if you’re unfamiliar with the terminology. That’s why we’ve put together this handy guide, making sure you’re well informed and ready to look into the best leasing deals for you.

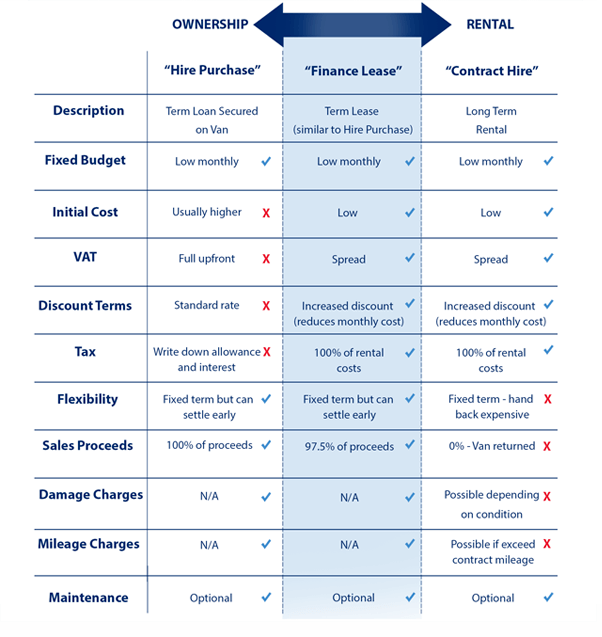

The three main options offered by a van leasing company are Contract Hire, Finance Lease, and Hire Purchase. While all three require monthly payments across an agreed term, there are some major differences to be aware of so that you can ensure you choose the right option for you and your business.

Looking at things simply, Hire Purchase is renting to buy, Contract Hire is renting to hand back, and Finance Lease bridges the two – with flexible options at the end.

There are benefits to each financing option; when looking at long-term van lease it’s important to find out which one works for you and your business.

This table sets out the main differences between van leasing and hire purchase van finance options:

Hire Purchase: May be the ideal option for you if like the idea of owning your vehicle, or plan to sell it for profit once you’re finished with it.

Contract Hire: May be the right option for you if want to take advantage of lower monthly payment and taxation. There is less risk, and you can hand back the vehicle once you’re finished with it (although it will be subject to excess mileage and damage charges).

Finance Lease: If you want the best of both worlds, this van leasing option may be right for you. You get to take advantage of low monthly payments and taxation, with more flexible contract terms.

Need more information on our finance options? Check out our Finance page for more details. Want to discuss Leasing Deals? Contact Us or call 01179625314 to speak to one of our Van Specialists

A guide to leasing vans through finance deals, including how they work and common terms. Van financing, also known as van leasing, works […]

Medium vans continue to be one of the UK’s most in-demand choice for tradespeople, fleets, and delivery businesses – and for good reason. […]

Finding the right commercial van to match your job can be a challenge – especially when budgeting, overheads, and reliability are added into […]

Van leasing is a great way to invest in your business. And while we know it’s much more cost-efficient than buying, it’s still […]

Looking for a large van lease, but you’re not sure which van to choose? We’ve got you covered. In this article, we’ll walk […]

Whether you’re a window cleaner needing to transport a 1000L tank, or you just need to make sure you can get materials and […]

Leasing a vehicle has lots of benefits for businesses. You’re able to spread the cost of your vehicle across the term of the […]